All you need to know about HS Codes (Harmonized System Codes)

HS Codes (Harmonized System Codes), also referred to as HSN (Harmonized System of Nomenclature) in India, are crucial for global trade. These standardized numerical codes classify goods systematically, ensuring consistency in tariffs, trade statistics, and regulatory compliance.

Whether you're an exporter, importer, or logistics expert, understanding HS Codes is essential to streamline your trade operations and avoid potential delays or penalties.

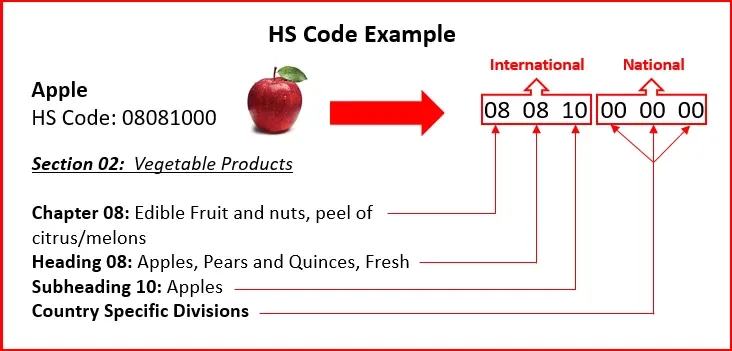

The Structure of HS Codes

HS Codes are organized hierarchically, with each digit or set of digits providing more specific classification:

- 2 Digits: Top-level categories (e.g., "01" - Live Animals).

- 4 Digits: Subcategories under the top-level (e.g., "0101" - Live Horses).

- 6 Digits: Further subcategories (universal worldwide).

- 8 Digits: Most detailed classification (country-specific).

Example: Hierarchy Levels

- 01: Live Animals (Top-level category).

- 0101: Live Horses, Asses, Mules, and Hinnies (Subcategory).

- 010121: Purebred Breeding Animals (Universal).

- 01012100: Country-specific detailed entry.

This hierarchical structure allows precise identification and categorization of traded goods.

Importance of HS Codes

- Uniformity: Ensures global consistency in the classification of goods.

- Regulatory Compliance: Determines applicable import/export duties, restrictions, and taxes.

- Trade Facilitation: Simplifies customs processes and reduces potential delays.

FAQ: Handling HS Codes Efficiently

General Questions

1. What is an HS Code?

An HS Code is a globally recognized classification system for traded goods. It standardizes tariffs, simplifies customs processes, and facilitates trade statistics.

2. How is an HS Code structured?

- First 6 digits: Universal worldwide.

- Next 2-4 digits: Country-specific for finer classification.

Finding & Using HS Codes

3. How can I find the correct HS Code for my product?

- Use your country's customs website or official HS Code directory.

- Consult a trade expert or freight forwarder.

- Leverage AI-powered tools or online HS Code search platforms.

4. Can one product have multiple HS Codes?

Yes. Products may have multiple applicable codes based on factors like material or purpose. Choose the most accurate one to avoid customs issues.

5. What happens if I use the wrong HS Code?

- Fines or penalties.

- Shipping delays.

- Reclassification and additional duties.

Regulatory Compliance

6. Are HS Codes the same in all countries?

The first 6 digits are uniform globally. Additional digits may differ by country.

7. How do HS Codes affect import/export duties?

HS Codes directly impact tariff rates, taxes, and restrictions. Accurate classification ensures correct duty calculations and compliance.

Advanced Topics

8. How are HS Codes updated?

The World Customs Organization (WCO) revises HS Codes every five years. Stay updated with the latest version to remain compliant.

9. Can HS Code classification be automated?

Yes, businesses can use software or APIs that analyze product descriptions and attributes to recommend HS Codes.

10. What’s the difference between HS, HTS, and Schedule B Codes?

- HS Code: Internationally standardized.

- HTS Code: U.S.-specific (up to 10 digits).

- Schedule B Code: U.S. export classification system.

Tips for Accurate HS Code Management

- Maintain detailed records of classified products.

- Regularly review and update your database with the latest codes.

- Work closely with customs brokers or freight experts.

- Use reputable online platforms for quick code verification.

Conclusion

HS Codes are indispensable for seamless international trade. From determining duties to ensuring regulatory compliance, their accurate usage minimizes risks and maximizes efficiency. By staying informed and leveraging modern tools, businesses can navigate the complexities of global commerce with confidence.

Call to Action

For more insights into HS Codes and trade compliance, explore official resources or consult industry experts.

Keywords: HS Code, HSN Code, Harmonized System, Trade Classification, Customs Tariff, Global Trade, Export Duties, Import Compliance, Trade Statistics, WCO HS Code.