Comprehensive Guide to AD Code

If you're planning to venture into the export business in India, securing proper registrations is essential. Two primary registrations are required to kickstart your journey: Import Export Code (IEC) registration and AD Code registration. While IEC is widely known, AD Code registration plays an equally critical role in ensuring smooth and lawful export operations.

What is Exporter AD Code Registration?

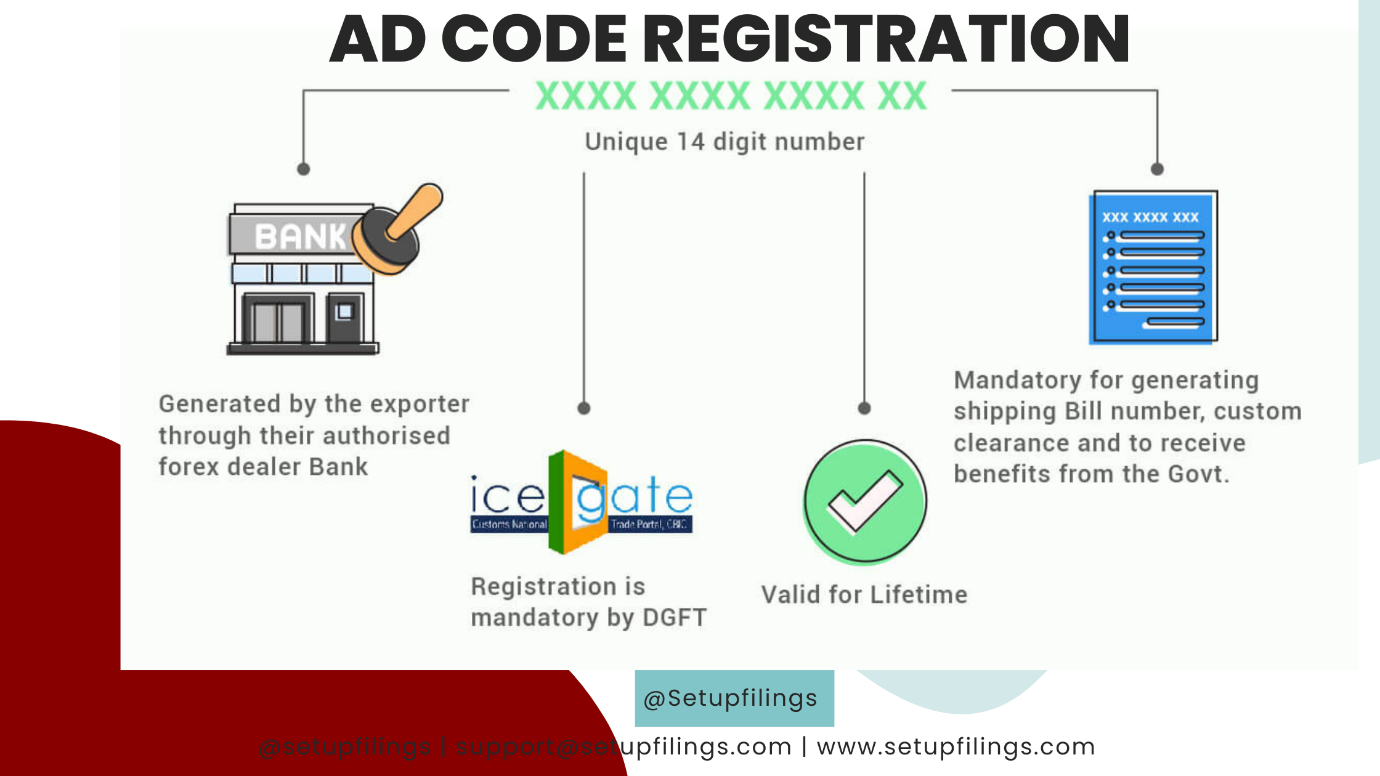

The AD Code, or Authorized Dealer Code, is a 14-digit number issued by a bank to exporters. It serves as a verification mechanism to ensure that monetary transactions involving foreign currency are legitimate and comply with Indian laws.

Why is AD Code Registration Important?

- Customs Clearance: AD Code registration is mandatory for clearing goods through customs. Exporters must register the AD Code for each port where shipments are processed.

- Transaction Tracking: The AD Code tracks foreign currency transactions through the exporter's current account, ensuring legitimacy and compliance with regulations.

- Government Benefits: Registering the AD Code with customs may make you eligible for government benefits, such as duty exemptions and refunds.

- Icegate Integration: Without an AD Code registered with Icegate (Indian Customs’ electronic data interchange portal), exporters cannot generate a Shipping Bill—a vital document for export clearance.

Key Features of AD Code Registration

- Port-Specific Registration: Each port or airport from which goods are shipped requires its own AD Code registration.

- Transaction Verification: Banks use the AD Code to verify the legality of all foreign currency transactions.

- Legal Compliance: The AD Code must be issued on the bank's letterhead and comply with the framework defined by the Directorate General of Foreign Trade (DGFT).

Import and Export Requirements for AD Code Registration

To register your AD Code, you’ll need the following documents:

- GST Registration: A self-attested copy of your GST registration certificate.

- IT Returns: Self-certified copies of the organization’s last three Income Tax returns.

- Bank Statement: A copy of the previous year’s bank statements.

- IEC Code Details: Information about your Import Export Code.

- PAN Card Details: PAN card copies for the organization, its members, and directors.

- Identity Proof: Aadhaar card, Voter ID, or other essential exporter information.

Steps for AD Code Registration

- Obtain AD Code from Your Bank: Request the AD Code on the bank's letterhead from the bank holding your current account.

- Port-Specific Registration: Register the AD Code with customs at the specific port where your shipment will be processed.

- Submit Documents: Provide all necessary documents, including GST, IT returns, and bank statements, to customs authorities.

- Integration with Icegate: Link the AD Code to Icegate to enable smooth electronic processing of Shipping Bills.

Important Considerations for AD Code Registration

- One-Time Application: You can apply for an AD Code only through the financial institution where you maintain your current account.

- Account Changes: If you switch banks, you must reapply for a new AD Code.

- Port Changes: For each new port where shipments are processed, you must register a new AD Code with customs.

- Validity Period: AD Code registration is valid for a specific period and must be renewed as required by customs authorities.

Benefits of AD Code Registration

- Customs Clearance: Simplifies the export process by ensuring compliance with customs regulations.

- Legitimate Transactions: Verifies the authenticity of foreign currency transactions through the exporter's bank account.

- Government Incentives: Unlocks benefits like duty exemptions and refunds, promoting smoother export operations.

- Seamless Export Processing: Enables the generation of vital documents like Shipping Bills through Icegate.

Conclusion

The AD Code is an integral part of the export ecosystem in India. It ensures compliance with regulatory requirements, facilitates smooth customs clearance, and helps exporters access government incentives. By registering the AD Code with customs for each port, exporters can avoid operational roadblocks and focus on growing their businesses globally.

Take the time to secure your AD Code and unlock a world of opportunities in the export sector!